Heavy Industries in Turkey

Turkey has strengthened its position in heavy industry sectors of all kinds, from military aircraft and electric trains to self-driving cars, and giant ship industries. Over the past two decades, Turkey has mobilized its full capacity to finance innovation and local development, freeing itself in such a short period from the import of its needs for heavy industries from abroad; and replacing this with self-manufacturing with high efficiency that has placed it among the world’s important industrialized countries. The last decade has also witnessed a giant revolution in light and consumer industries of all kinds, in addition to the marine industries sector, and the export of metals and steel, eventually achieving unprecedented figures in industrial and commercial history.

Turkey’s Position Among Countries Concerning Heavy Industry

Turkey is striving at full capacity today in a race against time to develop its industrial sector in heavy and light industry, competing with the strongest economies of the world, seeking to reach the third industrial place at the level of Europe. Heavy industries have enabled Turkey to overcome international and local challenges and obstacles to continue development programs and ambitious visions until 2023, which means a lot to the Turks. It was only natural for Turkey to benefit from the intensity and experience of the labor force, and the relatively competitive wages compared to the wage ratios of workers in other countries. It is surprising to find that major European companies are forced to close their factories in Europe and transfer their industrial equipment and entire laboratories to Turkey, to take advantage of the aforementioned factors, in addition to facing the turmoil witnessed in Europe and other countries.

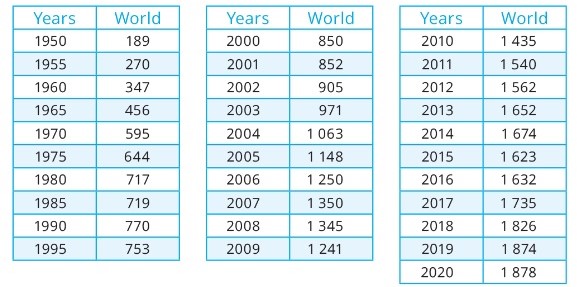

World crude steel production 1950 to 2020

Million ton, crude steel production

Turkish Steel Industry

Turkish steel production showed third yearly drop in 2015. On the other hand, global steel production fell for the first time in 2015 after the sharp drop during the global financial crisis in 2009. According to the World Steel Association’s data, in 2015 world crude steel production fell 2.8 % from 1.67 billion tons to 1.62 billion tons. While production dropped in all the regions, among all the 15 steelmaking countries, only India’s steel production grew. Aside from India, the other 14 steelmaking countries experienced decrease in production, however, Ukraine’s production rates suffered the most declining by -15.6%, USA followed with -10.5%. After Ukraine and USA, with -7.4 % production drop rate Turkey was the third country to have largest decline in steel production. Because of the sharp fall in production, Turkey lost its position in the world’s largest steelmaking countries list and dropped to 9th rank from 8th.

In the past years China and Asia were setting the upward production trend in the global scale, however, in 2015 they had the opposite effects on World steel production. In 2015 while total global steel production dropped by 48 million tons, crude steel production of China fell by 19 million tons Asia by 25.5 million tons. In 2015, China accounts for 49.5% of the world crude steel production.

According to Worldsteel data, global crude steel production capacity rose from 2.351 y-o-y to 2.384 billion tons in 2015. China’s crude steel production capacity, whose growth pace slowed for the last 2 years, is estimated to have increased from 1.140 billion tons to 1. 154 billion tons. According to worldsteel’s estimations, world crude steel consumption fell from 1.66 billion tons to 1.64 billion tons. The data mentioned, show that in 2015, around 750 million tons of capacity was idle throughout the world. In 2007 the surplus steel capacity was 270 million tons, however, in 2015 surplus capacity almost tripled and substantially damaged balance of the world steel industry together with the negative effects of the slowdown in the world steel consumption growth. During the last 10 years, China increased its total crude steel capacity by 172 % and in this respect accounted for around 71 % of the 1 million tons growth in the world steel capacity. As a result of the sharp growth in capacity and slowdown in consumption, Chinese surplus capacity reached 450 million tons.

Major steel-producing countries 2019 and 2020

After the global financial crisis in 2007, the demand declined rapidly, as a result, capacity utilization ratios of the World steel sector, started to decline from 85% and in 2009 it reached the lowest level with 68.9%. In 2014, the capacity utilization ratio which was on the recovery track, increased by 73.4%. In parallel to the production drop, capacity utilization of the world steel industry dropped from 73.4 % in 2014 to 69.7 % in 2015.

Export

In 2015, Turkey’s total iron & steel export, including pipes and the articles of iron & steel, dropped by 6.7% from 17.97 mt to 16.76 mt; while the value of the total export declined by 22.6% from 15.18 billion dollars to 11.75 billion dollars. Billet export, which had dropped in the recent years, continued its sharp fall in 2015 and declined by 46% to 304.000 tons. Flat steel export rose slightly by 1.7% to 2.54 mt. Long products, which is the largest export product group in Turkey, fell by 7.2% and declined to 10.2 mt. In 2015 61% of Turkey’s total steel export, consisted of long products, 15% of flat steel products, 10.8% of pipes and 1.8% of semi finished products.

In 2015, the sharpest drop was seen in the export tonnage to the Middle Eastern/Gulf region, which is Turkey’s largest export market. Since Chinese, Russian and Ukrainian steelmakers and exporters became more active both in Turkish market and Turkey’s export markets with lower and lower prices, Turkish steelmakers had difficulty in entering the main export markets where those competitors increased their existence. In 2015, total export of steel products to Middle Eastern and Gulf countries, fell by 13.4% (810.000 tons) and declined to 5.25 mt. Export to CIS region, dropped by 29% from 745.000 tons to 526.000 y-o-y in 2015. Export to the EU region, which is the second largest export destination of Turkish steel products increased by 4.3 % to 3.2 million tons; export to the USA rose by 5.7 to 2.36 mt, while export to North Africa grew by 22.2% to 2.32 mt. In 2015, 31.3% of Turkey’s total steel Middle East and Gulf region accounted for 31.3 % of Turkey’s total steel export, EU accounted for 19.2%, the USA 14.1% and North Africa 13.8% of the total.

Conclusion

Despite its success, Turkey’s heavy manufacturing industry faces challenges, including global economic uncertainties and fluctuating raw material prices. However, opportunities lie in technological advancements, sustainable practices, and strategic partnerships.

Turkey’s heavy manufacturing industry continues to thrive, driven by innovation, strategic investments, and a skilled workforce. As the country navigates global economic dynamics, its role in the heavy manufacturing sector is likely to remain pivotal.